|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

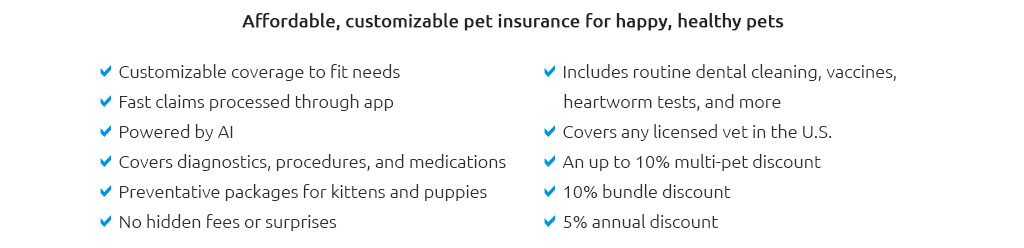

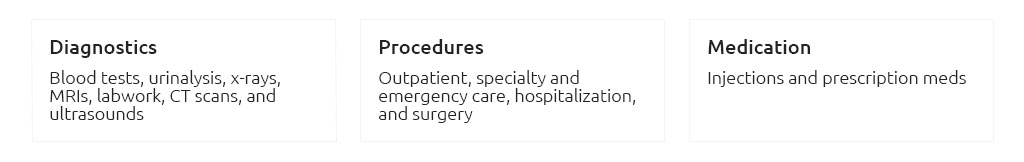

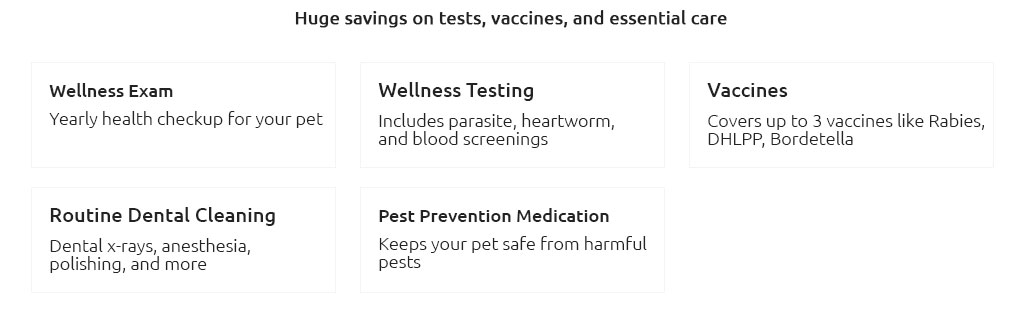

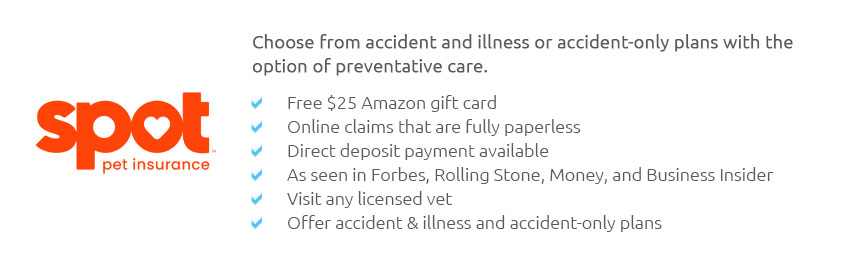

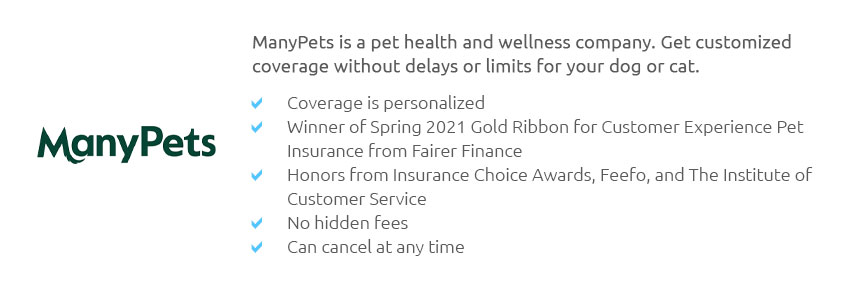

The Complete Beginner's Guide to Choosing the Best Pet InsuranceIn today's world, where pets have become cherished members of our families, ensuring their health and well-being is a priority that ranks right alongside our own. As veterinary costs continue to rise, pet insurance is increasingly seen as a practical solution for managing unexpected expenses. This guide aims to navigate the intricate landscape of pet insurance, highlighting the best options available and offering insights into what might work best for you and your furry friend. When embarking on the journey of selecting pet insurance, one might find themselves overwhelmed by the sheer number of options and variables to consider. Coverage types, monthly premiums, and deductibles are just the beginning. It's crucial to delve deeper into the specifics such as illness coverage, accident-only plans, and wellness add-ons. Understanding these elements forms the bedrock of making an informed decision. Start by assessing your pet's specific needs, which will depend on factors like age, breed, and health history. Some policies might offer comprehensive coverage but come at a higher cost, while others might be more budget-friendly but with limited benefits. Trupanion and Healthy Paws are often lauded for their extensive coverage and excellent customer service, making them popular choices among pet owners who seek peace of mind. Let's delve into some of the top contenders in the pet insurance market:

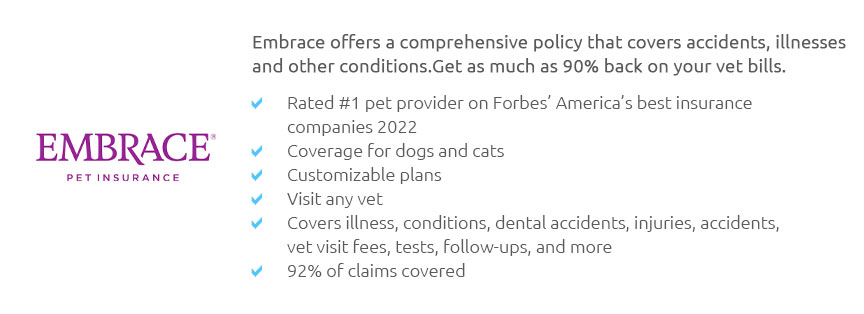

When evaluating these options, consider not only the cost but also the ease of claims processing and customer satisfaction ratings. Many pet owners find value in reading reviews and testimonials from others who have firsthand experience with these companies. Additionally, some insurers offer discounts for insuring multiple pets, which can be a boon for those with a menagerie at home. It's equally important to weigh the pros and cons of having pet insurance versus self-insuring by setting aside a dedicated savings fund for emergencies. While the latter gives you more control, it may not always be feasible to save enough for unexpected high-cost treatments. In conclusion, the best pet insurance is not a one-size-fits-all proposition. It requires careful consideration of your pet's health needs, your financial situation, and the level of coverage you feel comfortable with. By investing time in research and comparison, you can find a policy that not only fits your budget but also provides the assurance that you're prepared for whatever life throws your way. After all, our pets give us unconditional love, and it's only fair that we do everything we can to keep them happy and healthy. https://www.cnbc.com/select/best-pet-insurance/

Pets Best, Embrace and Lemonade are among out top picks for pet insurance. - Best pet insurance - Compare pet insurance and save - Best for ... https://www.bbb.org/us/nc/charlotte/profile/pet-insurance/pets-best-insurance-services-llc-0473-92020974/customer-reviews

Likely would not hurt, but so far, I have had timely and appropriate responses and service. Premiums may be a little higher than other providers, but I believe ... https://money.com/best-pet-insurance/

Our Top Picks for Best Pet Insurance of February 2025 - AKC - Best for Pre-Existing Conditions - Embrace - Best for International Coverage - Figo - ...

|